How To Save Money The Foolproof (And Fun) Way

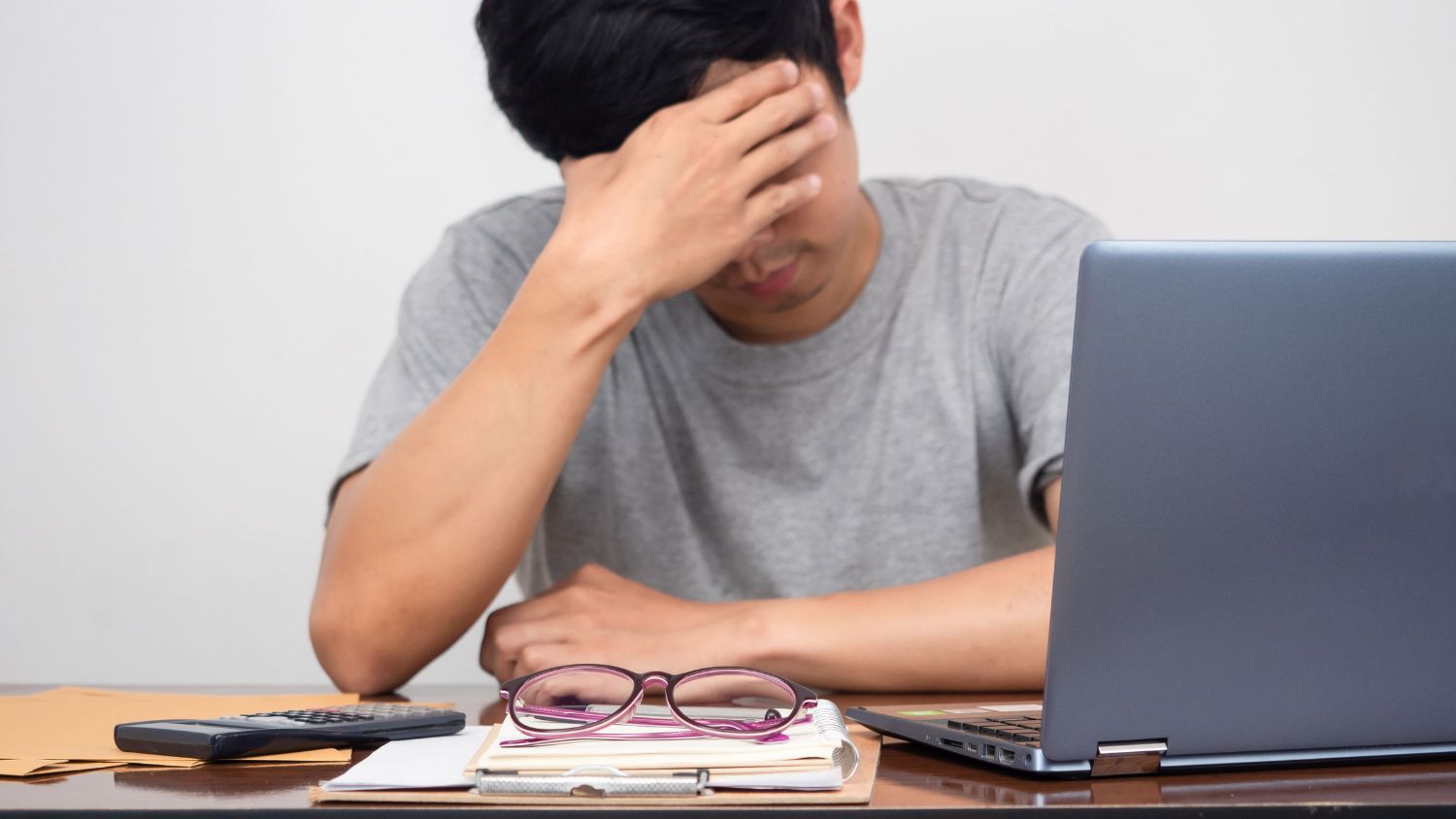

Are you finding it a chore to save money? Well, you’re not alone – apparently two out of three Singaporeans do not have savings that can sustain them beyond six months if they lose their income source. Aiyoh, cannot liddat lah.

With rising costs of living, it has become more important than ever to bolster your emergency fund. If you’re finding it difficult to put away excess money each month, you might want to try the following unorthodox (but fun) methods.

Hang out with a frugal pal

We all have that kiam siap friend – you know, the one who refuses to spend more than $4 on cai fan and never, ever splurges on Grab rides? If you’re having trouble building your savings, it’s time to turn to him/her for help.

For group outings, assign the frugal pal the responsibility of deciding the activities and meals for the day. Try doing that for a month, and perhaps instead of spending $100 on clubbing at Clarke Quay on a Saturday night, you could be saving hundreds of dollars per month by following what Mr./Ms. Frugal wants to do (which is to have fun the cheapest way possible).

Turn your boba cravings into savings

I know, I know. We all have the urge to drink boba at random times of the day, and it doesn’t help our case when there are a gazillion boba shops in a single mall. The next time that boba craving hits, take $10 from your wallet and put it into your piggy bank, or better yet, log into your banking app and transfer that $10 into another account that you won’t be touching.

Don’t have more than one bank account? Transfer $10 to someone you trust and have them “hold” the money for you while you let your cravings dissipate. Get them to transfer the total amount at the end of the month and be amazed at how much you’ve saved by not drinking boba! (Your blood-sugar level will thank you too.)

Twin with a friend who needs to save money too

You know how they say good things come in pairs? Well, what’s better than twinning with another friend who also needs to be more financially sensible? When you need to purge certain unhealthy spending habits, having someone else to go through the same struggle with you would definitely help.

Here’s how it works: each of you should decide for the other person one thing that he/she is not allowed to spend on for the entire month, and that person must oblige. This is fun because you get to see what your friend thinks you should really cut down on, and it can also help break the cycle of bad spending habits.

Start a swear jar (or one for a bad habit)

If your language tends to be of the, ahem, colourful kind, try starting a swear jar at home and drop $5 into the jar each time you let rip. Better yet, get your friends on board as well, and have them drop the filthy habit instead of contributing to your #financialindependence fund.

If you’re truly a saint who doesn’t swear (good for you), think about other bad habits that you need to cut and start a jar for that. For example, you could “fine” yourself $5 each time you decide not to do the dishes immediately. Either way, it’s a win-win!

Find new free things to do each week

Need to spend some quality time with your S.O, your fam or your squad over the weekend? Take up the challenge of finding a new activity that is F.O.C. every week – it’s not as hard as it looks! (Psst, we are here to help.) You’d be surprised at the list of complimentary things you can do in Singapore. Plus, you can always brag about helping your loved ones save money too.

Play “Who Wants To Be The Biggest Saver?”

How to make saving money really fun is by gathering a group of like-minded people who need to be thriftier, and gamifying the whole experience. Compete against each other and see who can save the most in a month using the carrot-and-stick approach. For instance, by enforcing that the one who saves the least will have to treat the winner to a meal.

For the latest updates on Wonderwall.sg, be sure to follow us on TikTok, Telegram, Instagram, and Facebook. If you have a story idea for us, email us at [email protected].